When My Small Maryland Business Should Start its Taxes

December 27, 2016

As tax-season approaches, you may be wondering when is the best time to start your taxes. In Maryland, it is best for small businesses to start preparing their taxes well before the due date. In other words, it is best to always be preparing your taxes, and here’s why.

Easier to File

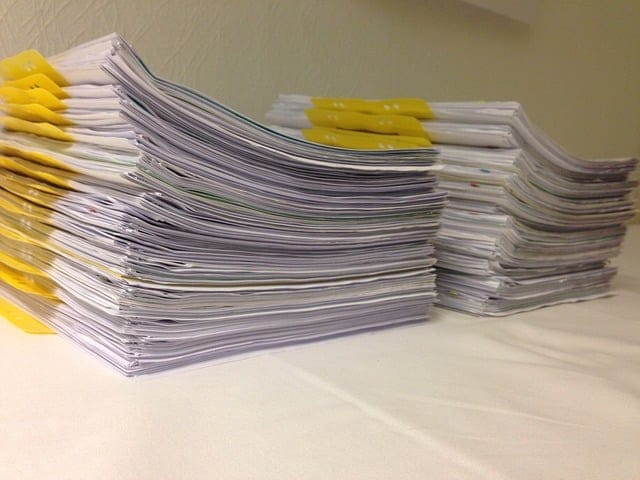

If you wait until the last possible moment to file your taxes, it will be much harder to file them. This is simply because you will be scrambling to find all the necessary documents for a proper filing. Make tax preparation for your small Maryland business an on-going process so you’ll have everything ready for when tax time comes.

Less Stress

Tax preparation is stressful, we get it. This is why staying on top of your tax-preparation year-round is a smart idea. It will make it so when crunch time comes, you’re not put up against a deadline with all the other responsibilities required of a small business owner in Maryland. By preparing your taxes earlier than necessary, you can reduce your stress when tax season is really here.

Catch and Correct Issues

Issues can come up when filing taxes. By preparing for this possibility you can minimize the hassle of correcting those issues by simply catching them as they happen. This will not only give you time to correct the issues, it can also allow you the opportunity to seek external tax help. If you can, submit your tax preparation documentation to your tax professional early. It gives them the time to take a good look at your taxes, catch any issues, and then correct them.

Hire Help

If you hire outside help from a certified public accountant, you won’t need to worry about tax-preparation much at all. They can simplify everything for you, and help you to maximize your profits while minimizing your overall taxes. You’re concerned with running your business, one of the last things you want to be worried about is taxes. But unfortunately, taxes can be one of the more important parts of your bottom line. Fortunately, a CPA firm can help.

Looking for a Maryland public accountant to help you with your Maryland small-business tax preparation? Relate CPA it a certified Maryland accounting firm who prefers to be thought of as friendly tax professionals, not some uncaring, corporate CPA firm. Relate CPA will work with you, year-round, to ensure when tax time comes you are in the best position for your Maryland business. Contact Relate CPA today for a free consultation.

<< Back to BlogRegions Served

Florida Accounting Services

Lake County Accounting Services: Astatula (34705), Clermont (34712), Eustis (32727), Fruitland Park (34731), Groveland (34736), Howey-in-the-Hills (34737), Lady Lake (32159), Leesburg (34749), Mascotte (34753), Minneola (34755), Montverde (34756), Mount Dora (32757), Tavares (32778), Umatilla (32784), and more.

Orange County Accounting Services: Apopka (32702, 32704, 32712), Bay Lake (32830), Lake Buena Vista (32830), Maitland (32751, 32794), Ocoee (34761), Orlando (32801,32805, 32809, and more), Winter Garden (34777, 34778, 34787), Winter Park (32789, 32790, 32792, 32793), and more.

Seminole County Accounting Services: Altamonte Springs (32701), Casselberry (32707), Lake Mary (32795), Longwood (32750), Oviedo (32765), Sanford (32771), Winter Springs (32708), and more.